Mortgage interest tax deduction 2023 calculator

It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

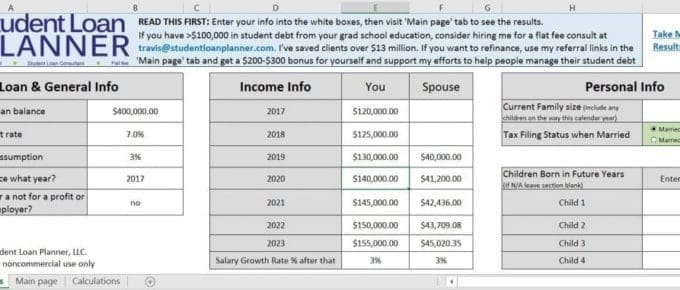

Student Loan Repayment Calculator 2022 Forgiveness Ibr And Refi

Can interest be deducted.

. It is mainly intended for residents of the US. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Mortgage Tax Deduction Calculator.

In 2021 you took out a 100000 home mortgage loan payable over 20 years. They earn rental income of 12000 for the year They pay. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Use this calculator to see how much.

IRS Publication 936. Throughout the course of your mortgage the interest on your mortgage. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

877 948-4077 call Schedule a Call. The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Prepare and e-File your.

As noted in general you can deduct the mortgage interest you paid during the tax year on the first 1 million of your mortgage debt for your primary home or a second home. You paid 4800 in points. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

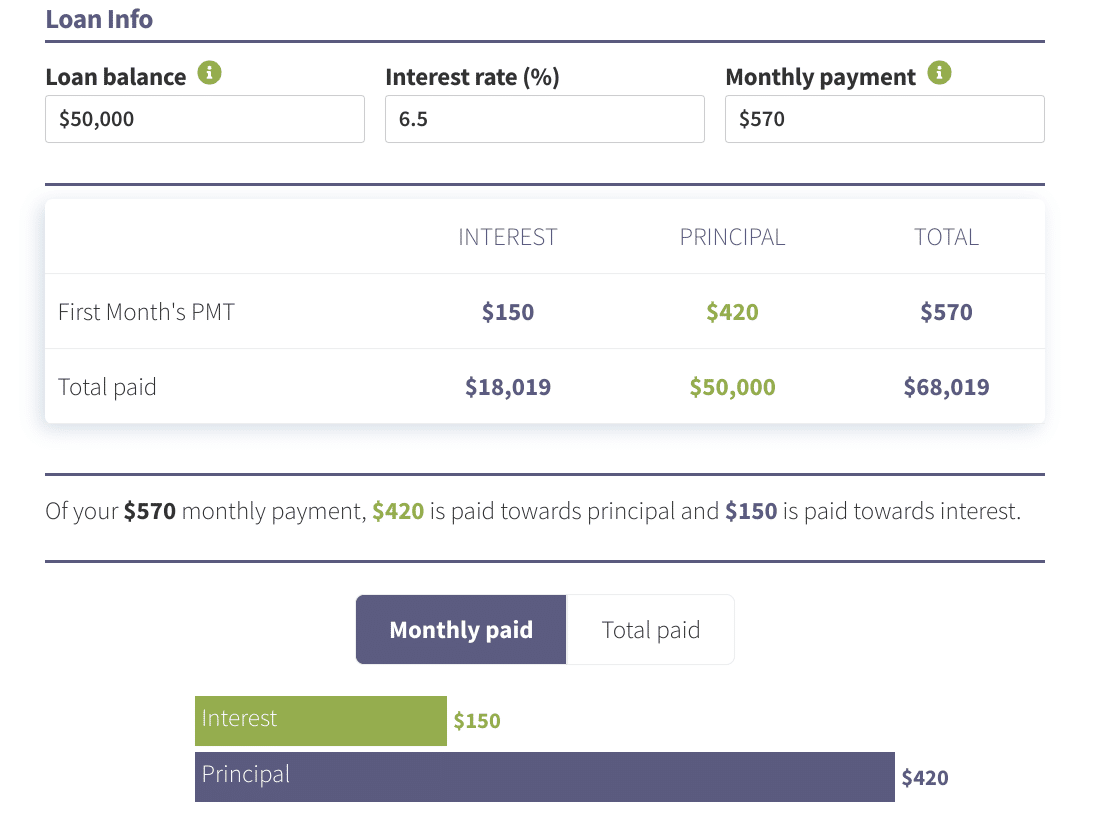

If a taxpayer or business pays interest in certain cases the interest may be deducted from income subject. The mortgage interest deduction allows homeowners who itemize their deductions on their tax forms to deduct their interest on qualified personal residence debt. From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000.

Interest deduction causes a reduction in taxable income. For married taxpayers filing a separate return this limit. And is based on the tax brackets of 2021 and.

Our Resources Can Help You Decide Between Taxable Vs. The terms of the loan are the same as for other 20-year loans offered in your area. Ad Work with One of Our Specialists to Save You More Money Today.

Points are prepaid interest and must be amortized with just a portion of the original prepaid expense being deducted each year of the. For a landlord charging 1000 per month rental income and with mortgage interest payments of 650 per month it worked like this. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

1

1

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

:max_bytes(150000):strip_icc()/housecalculator-56a7dc723df78cf7729a0745.jpg)

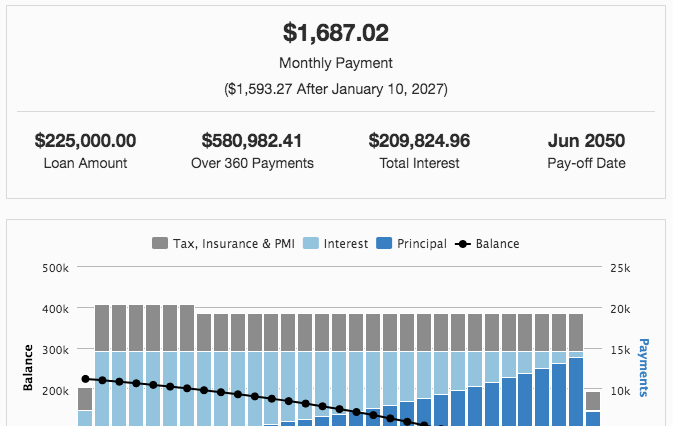

Mortgage Calculator

Adjusted Gross Income On 1040

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

/GettyImages-552980487-56a0a5f33df78cafdaa3928e.jpg)

What Is Amortization

Mortgage Calculator With Down Payment Dates And Points

Simple Tax Refund Calculator Or Determine If You Ll Owe

Student Loan Repayment Calculator 2022 Forgiveness Ibr And Refi

Mortgage Amortization Calculator Crown Org

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Agi Calculator Adjusted Gross Income Calculator

Student Loan Interest Calculator Student Loan Planner

Lastmilepublish I Will Provide An Excel Refinance Mortgage Calculator For 10 On Fiverr Com Refinance Mortgage Mortgage Refinance Calculator Mortgage Calculator

1